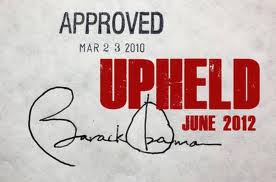

When the Affordable Care Act is involved.

Though Texas will join 26 other states in defaulting to a federal marketplace for purchasing health insurance — a major component of the Affordable Care Act — it is one of only six that will not enforce new health insurance reforms prescribed by the law. It’s a decision some say could lead to confusion over who’s responsible for protecting Texas insurance consumers.

Because Texas did not create its own state-based marketplace, known as a health insurance exchange, under the Affordable Care Act, it must use a federally facilitated one instead. By federal law, the state must enforce provisions and regulations related to the insurance exchange and market reforms unless it notifies the federal government that it cannot or will not. If a state does not enforce those reforms, the federal Centers for Medicare and Medicaid Services will step in to do it.

Texas, Arizona, Alabama, Missouri, Oklahoma and Wyoming have all notified the federal government that they will not be policing the health law. John Greeley, a spokesman for the Texas Department of Insurance, said his agency cannot enforce regulations tied to the federal insurance exchange or market reforms because it is not authorized to do so.

“We can’t act on anything that doesn’t exist in state law,” he said.

[…]

In the states that will not enforce the exchange and market reforms, the federal government will have to review insurance forms and respond to consumer complaints about health insurance, said Kevin Lucia, an assistant research professor with the Georgetown University Health Policy Institute’s Center on Health Insurance Reforms. Those duties, he added, are “typically reserved for state insurance departments.”

[Stacey Pogue, a health policy analyst with the liberal Center for Public Policy Priorities] said the state’s decision could create an “administrative burden” for insurance plans and could result in confusion for Texans who purchase health insurance under the federal exchange. For instance, she said, if people worry their insurance providers are discriminating against them based on their gender — a practice banned by the federal reforms — they may not know whether to report a complaint to CMS or to TDI.

“There’s all this opportunity to be bounced back and forth, which is a burden for consumers,” she said. If consumers have to report insurance violations to the federal government, that could prevent TDI from having a complete picture of consumers’ experience with insurance providers, she added.

“Consumers can be experiencing a lot of problems on the market that the state regulator doesn’t know about,” Pogue said.

That would be a feature, not a bug, as far as the state leadership is concerned. They care far more about scoring a political win by making the Obamacare implementation look bad than they have ever cared about actually solving the problem of people not having health insurance. How much effect this will have I can’t say – the Texas Department of Insurance claims they’ll still be there for Texans that have problems, for whatever that’s worth – but the bottom line remains that the state is determined to do everything in its power to keep as many people off health insurance as possible. After all that chest-thumping about being severely “pro-life”, you just have to wonder how some of these people sleep at night. But at least now we don’t have to wonder about when the federal government is evil and intrusive and anathema, and when it is not. Think Progress has more.