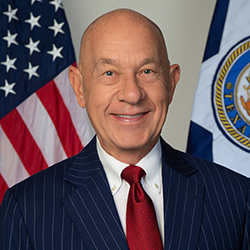

Mayor John Whitmire gave his first State of the City address this week. Here’s the preview story for what we were to expect.

Mayor John Whitmire will lay out his administration’s priorities during his inaugural State of the City address next Tuesday.

The Mayor’s Office announced Friday that Whitmire is scheduled to deliver his speech at a luncheon hosted by Houston First Corporation and the Greater Houston Partnership, where he will discuss his plans to promote the city’s economic growth and quality of life.

[…]

Whitmire will “offer his insight on the city’s key challenges as well as strategies to successfully shape Houston’s future” during the Tuesday luncheon, the announcement said. The mayor recently said he would rather cut expenditures than raise the property tax but has not specified how he plans to reduce spending. Other city officials warned that cuts of this magnitude could affect essential services like libraries and garbage collection.

OK cool. There’s always some amount of highlighting and celebrating the key achievements along the way, along with the message about how we will build on those and what we plan to do next. Sounds good. And then we got this.

In his first State of the City address on Tuesday, Mayor John Whitmire mostly stuck to the past, whether it be his accomplishments on his road to becoming Houston’s mayor or the perceived failures of the past administration.

The mayor spent the first 30 minutes of his nearly 45-minute chat in front of more than 1,600 audience members at Hilton Americas taking questions about his time prior to being Houston mayor. Moderator William F. McKeon, the president and CEO of Texas Medical Center, flashed photos from the mayor’s childhood, his hometown of Hillsboro and some during his time as dean of the Texas Senate on the screen, at one point asking Whitmire to identify the shape of inkblots to prove the mayor was speaking off the cuff, before finally asking a question on city and county collaboration.

Whitmire took questions about some of the biggest top-of-mind issues surrounding the changes has made in his eight months in office so far after the address.

His administration has said repeatedly it inherited a bevy of issues when he took over this past January.

Whitmire’s team made a gamut of changes to fix some of those issues. The mayor made due on his promise to the fire union and settled the more than $1.5 billion deal, and he proposed and passed a new budget that included no tax hikes for city residents or extra fees.

Yet as financial concerns rise, the mayor in his Tuesday talk did not address topics surrounding the impact of his changes – like how his administration will pay the $1.5 billion fire settlement or plans to potentially raise taxes to offset damages incurred from Hurricane Beryl, among others.

One upcoming change he teased out in his talk and elaborated on to reporters after the event was a plan to open navigation centers around the city with Housing Director Mike Nichols and homeland security director Larry Satterwhite to help get the city’s unsheltered population off the streets.

He also reiterated that he wasn’t going to raise taxes until his administration had done the best it could to eliminate waste, duplication and corruption.

“Property taxes right now is not on my agenda,” Whitmire said. “Property tax increase is not something I have scheduled because, quite frankly, you have to look at the totality of the picture with the HISD bond, with the Harris County drainage maintenance fee.”

And as far as his next four months go, he said the city needs to work on resilience and building its public safety sectors, as well as dealing with its water supply.

The mayor did not give a timeline for when he would roll out a plan to address city finances, but the deadline to make any change is Oct. 28.

“We got some time,” Whitmire told reporters.

OK then. I guess the State of the City address wasn’t the time to talk about that.

I do want to address the property tax situation, because last week we got this.

Following widespread damage from Hurricane Beryl and the May derecho, Mayor John Whitmire’s administration is considering higher-than-usual tax rate hikes to pay for nearly $40 million in recovery costs.

The two disasters have left Houston with an estimated bill of $211 million, which includes the costs of debris removal, emergency efforts like flood mitigation, as well as repairs to local roads, buildings and utilities, according to finance director Melissa Dubowski.

The Federal Emergency Management Agency is anticipated to cover about three-quarters of the cost, or $158 million, leaving the city responsible for the remaining $53 million, Dubowski said. Of the city’s share, about $40 million will come from the general fund, primarily supported by tax revenue, and $13 million will come from other funds tied to specific operations like airports.

Houston already faces a $160 million budget shortfall for the fiscal year that began in July, and the city’s recent agreement with the firefighters union is expected to put further strain on its finances.

To avoid further budget cuts and cover the $40 million from disaster-related costs, the city would need to raise the tax rate by at least 3.2 cents per $100 of property value, Dubowski said. For the average owner of a homestead property, this would mean an annual tax bill increase of about $166 from the current tax year.

Mary Benton, Whitmire’s spokesperson, said the mayor’s current priority is to reduce expenditures and avoid raising taxes. She noted that Whitmire is prepared to push the City Council to reduce the budget but did not offer specifics about his planned reductions.

Council Member Sallie Alcorn, chair of the Budget and Fiscal Affairs Committee, said it might be challenging to find sufficient budget cuts without impacting essential city services.

“Nobody likes to raise a tax rate — we’ve been lowering it for 10 years — but we’ve also been hearing complaints about city services in decline for several years,” Alcorn said during a Monday committee meeting. “We scrubbed the budget as much as we could. … If we’re talking about additional cuts, we’ll get something like the library budget, the solid waste budget.”

[…]

As a result of the city cap, Houston has had to cut its tax rate in nine of the last 10 years, from 63.88 cents per $100 of property value in 2014 to 51.92 cents in 2024. Altogether, the restriction has led to $2.2 billion in lost revenue over the past decade, and Houston’s current tax rate is lower than that of all major Texas cities except Austin, according to Dubowski.

City and state laws, however, allow exceptions in the case of a declared disaster. So far this year, Gov. Greg Abbott has issued three disaster declarations for Harris County — one for flooding in April, another for the May derecho and a third for Hurricane Beryl in July. This gives Houston the option to significantly raise its tax rate.

On Monday, Dubowski outlined several tax rate scenarios for the upcoming tax year. At the lower limit, if the city keeps the current rate, it would need to cut an additional $86 million from its budget. At the upper limit, if the city adopts the maximum rate legally allowed under disaster exceptions, it could not only avoid cuts but also generate a $79 million surplus, which Dubowski said could further help fund disaster recovery efforts.

The finance director emphasized the tradeoffs between tax savings and service delivery.

“People want more done with their garbage collection. They want to have public safety as a priority with more officers. We saw the lack of having a contract with the fire department for so many years,” Duboswki said. “There’s both sides of the same coin. Yes, you had a lower bill, but your services have been impacted as well.”

The disaster exceptions, officials said, offer an opportunity for the city to restore some financial stability. Houston invoked the same exceptions to collect more revenue after the Memorial Day Flood in 2015, the Tax Day Flood in 2016 and Tropical Storm Imelda in 2019. It did not do so after Hurricane Harvey in 2017, Dubowski said, when the city received more financial support from the federal and state governments.

Yes, I know, no one likes paying higher property taxes. I’m a homeowner, I’ll feel the effect of any hikes. But I don’t see how going another $40 million in the hole is in any way “fiscally responsible”. We have this one time opportunity to not only pay for the damages caused by two major storms, but also generate a little extra revenue beyond that, which among other things could be a down payment on the pay raise we’re giving the firefighters and the police. But sure, keep looking for waste, and no rush telling us what in the budget you’d cut.

Oh, and in regard to the concern about the HISD bond referendum: Assuming it does pass, which is not a bet I’d make, HISD swears that it won’t involve a tax increase. There is a reason why that’s a credible claim, which is that HISD has basically paid off the 2012 bond by now, so there’s room in the budget for the next bond payments. That’s a subject I explored in a forthcoming interview with proponents of the bond; look for that soon.

Whitmire won with Republican support and the progressive and gay coalition. He can’t raise taxes without Republicans’ approval, and depending on who runs against him, I can’t see the same coalition not sticking with him.

A tax increase without voter approval is a no-no for Republicans.

Maybe One-term can find something in his past that will guide him in his future endeavors after he leaves office three years from now, and Houston can begin to reverse the damage and move forward again.