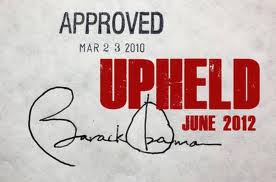

Texas can resist all it wants, the health insurance exchanges will be here in 2014, with signups beginning in October, whether Rick Perry and Greg Abbott like it or not.

The federal Health Insurance Marketplace at www.healthcare.gov is scheduled to open on Oct. 1 — two months from now. Enrollment will be open until March 31, though those who sign up before the end of the year can start getting coverage on Jan. 1.

For a little over half of Texans, health insurance will remain a job benefit. People who get health insurance through their employer won’t need to use the new insurance exchange. It is meant for people who buy insurance on their own, or who don’t have health insurance.

“The plans are going to be affordable, but we really haven’t seen what the prices are going to be yet,” said Mimi Garcia, Texas director of Enroll America, a nationwide campaign to get people to take advantage of insurance made available under the Affordable Care Act. The group has strong ties to President Barack Obama’s administration and to the health care industry.

Bert Marshall, president of Blue Cross Blue Shield of Texas, said recently that premiums are going up for individuals, but the cost will depend on subsidies keyed to a person’s income.

The Society of Actuaries (professionals who analyze the financial consequences of risk) took a detailed look at the cost of individual and small group insurance policies marketed across the country, and projected how the Affordable Care Act would change that landscape. In Texas, they estimated the monthly premium for the average individual policy would go from $249 in 2013 to $333 in 2014 under the Affordable Care Act.

The study also estimated that the uninsured rate in Texas would fall under the law from 27.1 percent of the population to 10.2 percent.

Federal health official Hash said premiums have come in lower than expected in several states that have announced average rates, such as California, New York and Montana.

[…]

Currently, the state’s individual insurance market, where people buy coverage for themselves with no help from an employer, serves only about 5 percent of the population. The market is unavailable to or prohibitively expensive for people with chronic health conditions, said former Texas Medicaid official Anne Dunkelberg.

“The current individual market includes few older or sicker people — they are either denied or priced out,” said Dunkelberg, associate director of the Center for Public Policy Priorities, which supports the federal law and advocates for low- and moderate-income Texans.

“Only the sickest and those who can afford it get [state] risk pool coverage,” she said, referring to a subsidy program for 23,000 Texans, including nearly 2,400 in Dallas County and 1,400 in Collin County.

It is scheduled to cease operations when the federal law’s ban of denying a person coverage for a pre-existing condition takes effect Jan. 1.

“Average rates must increase when we move to a world where no one is denied,” Dunkelberg said.

[…]

This year, thousands of individual insurance policies were available in Texas with annual premiums ranging from $363 for a single, nonsmoking man under 30 to $8,387 for a single 30-year-old woman who smokes. The plan costing the least — $30.25 a month — is a catastrophic care policy that doesn’t provide insurance until after the policyholder spends $10,000, and then only picks up half the tab until the policyholder has spent $17,000.

The most expensive policy — at $698.92 a month — provides insurance once the policyholder has spent $500. It picks up 80 percent of the cost of healthcare until the policyholder has spent $3,000, and then absorbs all of the cost.

The variety of plans won’t necessarily end once the Obamacare marketplace goes into effect. But unless the plans meet the requirements of the new law, purchasers could still face the penalty for not buying insurance. In 2014, that penalty will be $95 or 1 percent of income, whichever is greater. The penalty increases in 2015.

Cigna’s Smithberger said premiums in Texas could go down as well as up, depending on the buyer. The Affordable Care Act limits the difference insurers can charge because of a person’s age, for example. That could mean higher premiums for young people, but lower premiums for someone older.

“I would venture to say even in Texas some people may be seeing significant premium decreases based on their age and health status,” he said.

You can find that Society of Actuaries study, which was released in March, here, with the data here. Note that in a previous post I said that full participation in the exchanges could lead to Texas’ share of uninsured people to drop from 27.1% to 14.9%. The DMN story says 10.2%, which I believe is a mis-reading of the data. That lower figure is what the uninsured population would be if Texas also expanded Medicaid. In the absence of Medicaid expansion, which is the situation we are dealing with, the higher figure applies. The tables from which I get this are S1 and S2 on pages 7 and 8.

Note also that when one talks about the cost of policies under the Affordable Care Act and the insurance exchanges, it’s policies on the individual market that we’re talking about. If you get your insurance through your employer (or your spouse/partner’s employer) or some other group, that’s not a part of this calculation, as those policies are not part of the exchange. This is a point that Kaiser Health News attempted to clear up:

Q: Does the study predict health insurance premiums will go up 32 percent by 2017?

No. First, it’s only forecasting the individual insurance market. That’s where millions of Americans newly covered under the ACA are expected to find policies. The report says nothing about costs for employer-based health insurance.

Equally important, the 32 percent forecast is for medical expenses paid by insurers, not what insurers will charge in premiums, and not what consumers will pay.

Q: But if medical claims go up, shouldn’t insurance prices also go up? How much difference could there be?

A: In the individual market designed under the health law, quite a bit, say supporters. The ACA limits insurer profits and also gives government regulators oversight of rate increases, both of which could hold premiums down.

Even if sticker prices rise, an important feature of the health law is subsidies for people to buy insurance, through tax credits for those with lower incomes. So what many newly-insured people actually end up paying themselves won’t be the same as what the insurance company bills.

Thanks partly to subsidies, “many people buying individual coverage today will see decreases in costs,” said Larry Levitt, senior vice president at the Kaiser Family Foundation. (Kaiser Health News is an editorially independent program of the foundation.)

Insurers who end up signing lots of sicker members will also be partly reimbursed for several years by a reinsurance pool designed to lower their risk. That will lower their expenses, and it wasn’t accounted for by the SOA study.

Q: Does it matter where I live?

A: Yes. The report found huge variability, based on geography. While the estimated increase would be 62 percent for California by 2017, in New York state, the report estimates claim costs would drop by almost 14 percent.

Q: Will health plans offer the same coverage in 2017 that they do now?

A: That’s another reason the 32-percent headline could be misleading. Thanks to ACA minimum coverage requirements, benefits will be more generous starting next year. So what insurers pay in claims can expected to be higher, too.

“The number of people who are underinsured has grown dramatically over the last decade,” said Sara Collins, a vice president at the Commonwealth Fund. “One reason claims might be a lot lower now is the benefit package is so crummy.”

The health law was intended to shift spending into the commercial insurance system that is now outside it: high out-of-pocket costs for those in low-benefit plans; uncompensated emergency-room care; patients paying in cash, and so forth. Moving those costs under the insurance umbrella increases insurance-based spending.

Q: The idea of the insurance exchanges is to create competition, isn’t that supposed to lower costs?

A: Yes. The idea behind state health exchanges is that insurers will compete for business by pressing providers for discounts and passing part of the savings to members. The actuary study didn’t account for that kind of competition.

“Every insurer I’ve talked to says they’re building lower-cost networks that they plan to use for their exchange plans,” said Levitt.

It’s a complex situation with a fair bit of nuance, which means that it’s ripe pickings for all manner of liars, hucksters, and shameless partisan hacks who want to see this fail because they care more about their ideology than a bunch of uninsured people. The bottom line is that unless you are currently uninsured, you are almost certainly not going to be directly affected by this. If you are currently uninsured, you will have the ability to buy an affordable health insurance plan that actually covers things. You’ll have to make some decisions about how much you want to spend for varying levels of coverage, but the choices you’ll have will be realistic and worthwhile. Keep all that in mind when you see some apocalyptic warnings in your inbox or on your Facebook wall. Consider the source, because there’s going to be a lot of propaganda and misinformation out there. Thankfully, as of October, we’ll have some hard facts. Hang on till then.

I’m skeptical. I know a number of folks who use the County facilities because they are free. Unless the County starts turning them away, or starts requiring a lot more money up front, there’s little incentive to pay for insurance, even if it’s cheap. Of course, setting the penalties higher than the cost of insurance would go a long way towards fixing that problem, but there’s no political will to do that.