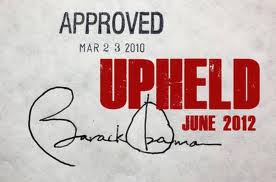

By now you’ve surely heard about the CBO report on the Affordable Care Act and the workforce, which despite some terribly botched reporting does have a lot of political considerations. There’s something I’d like to point out about this before we get too bogged down in attack ads. Let’s start with Kevin Drum putting a name to the reason behind the effect on the workforce.

Obamacare will reduce employment primarily because it’s a means-tested welfare program, and means-tested programs always reduce employment among the poor.

[…]

If, for example, earning $100 in additional income means a $25 reduction in Obamacare subsidies, you’re only getting $75 for your extra work. At the margins, some people will decide that’s not worth it, so they’ll forego working extra hours. That’s the substitution effect. In addition, low-income workers covered by Obamacare will have lower medical bills. This makes them less desperate for additional money, and might also cause them to forego working extra hours. That’s the income effect.

This is not something specific to Obamacare. It’s a shortcoming in all means-tested welfare programs. It’s basically Welfare 101, and in over half a century, no one has really figured out how to get around it. It’s something you just have to accept if you support safety net programs for the poor.

Kevin expands on his thesis here. The point is simple enough – for people at a certain income level, a raise in income can mean a significant reduction in a benefit like the ACA exchange subsidies, or even the loss of eligibility for that benefit at all. That was touted as an advantage to the Arkansas option for expanding Medicaid, as it would help avoid the situation where people near the line for eligibility see their status swing back and forth. In addition, the decoupling of health insurance from employment was a feature of John McCain’s health care plan from 2008, back before Obamacare made increasing access to health insurance an evil that threatened Ted Cruz’s manhood.

Which brings me to Texas. What does this have to do with Texas? Very simply, Texas has done means testing for its Children’s Health Insurance Program (CHIP) since 2003. Allow me to quote myself from 2006, when restoring cuts to CHIP was a campaign issue in that year’s gubernatorial race.

The point of CHIP is to provide a benefit for lower-income working families. It’s not Medicaid. It’s a program to give health insurance to the children of people who couldn’t otherwise afford it. Before HB2292 in 2003, it didn’t have an asset test, which means that those families could try to put some money aside to save for their kids’ future college educations without it costing them their CHIP eligibility. Not any more: As of 2003, CHIP families with incomes at 150% of the federal poverty level can have no more than $5000 in total assets before losing CHIP. That includes savings, and most frustratingly, automobiles. There’s a $15,000 exemption for a first car, and a $4650 exemption for a second, meaning that a family in which both parents work, one of them had better be driving a junker (or not driving at all) or it’ll go against their ability to get health insurance for their kids. And you better hope your kids qualify for scholarships some day, because you can’t save for their tuition costs.

In that post, I’m summarizing a document provided by Rep. Garnet Coleman, which you can see here, that explained the changes made to CHIP eligibility in 2003 that were passed by the Republican legislature and signed by Rick Perry. It should be noted that these changes were made with the express purpose of booting kids off of CHIP, which is a horrible thing to do and awful, self-harming public policy. But at the margins, it likely had the same effect that the CBO is describing for the ACA. If you had been receiving CHIP and were near the eligibility boundary when the new restrictions were put in place, you might well consider doing things to reduce your household’s level of employment in order to maintain that very needed benefit for your kids. Options would include cutting back on your hours, giving up a second job, having one spouse or the other quit their job, and so on. The means testing requirements have shifted around since then, but they’re still there. I don’t see anyone freaking out over it, if they’re even aware of it.

Anyway. It’s true that some people will quit working now that they can continue to be eligible for health insurance. As many people have pointed out, they’re doing so because they’re better off now. We generally consider that to be a Good Thing. CBO projections aside, the overall effect on the labor market remains unclear, and will no doubt be studied to death in the next decade. But the claim that the CBO report means that Obamacare is “killing jobs” is a flat out lie, one that even some opponents of the law understand.