Good.

Houston next week will launch an effort to scoop up dangerous properties left to rot in so many aging neighborhoods, raze them and resell the land.

Officials say the program, approved unanimously Wednesday by the City Council, could more than double the number of buildings demolished each year, help the city recover more of the money it spends fighting blight and get the lots back on the tax rolls more quickly.

“Many of these properties have sat vacant and tax-delinquent for many years, some of them for 20 years,” said Katye Tipton, director of the city’s Department of Neighborhoods. “They’ve got a really rotten building on them, nobody is interested in buying this thing; I wouldn’t. So, the city goes in, we clean up the property. Within 60 to 90 days we’ll take it back to sale. Now, it’s a much more appealing property.”

[…]

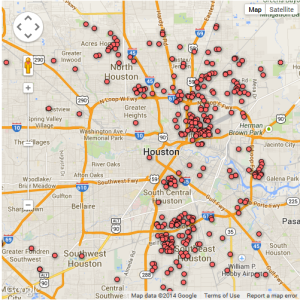

Of Houston’s 4,317 blighted houses, strip centers and apartment complexes, most of which are clustered in poor and minority neighborhoods like Settegast, the city is on track to raze only 153 this fiscal year.

Hurdles have included a lack of resources, state laws that limit the city’s ability to interfere with private properties, and often muddled ownership that makes it hard to hold someone responsible for a property’s poor state.

The program approved Wednesday would apply only to the roughly 40 percent of dangerous buildings that are tax delinquent.

Those that do not sell at auction for at least the delinquent taxes, penalties and interest, can be acquired by the city and cleaned up for resale. The city would be responsible for maintenance, but would be first in line to recover its cleanup costs before other local governments get the taxes owed them.

Typically, Houston gets back less than 1 percent of its cleanup costs when it condemns and demolishes a property without taking ownership, because the city is last in line to recoup its costs under state law. When it has taken lots into inventory in the past, however, the city has recovered about 40 percent of its costs.

“Really, anything over the 1 percent is gravy right now,” said Kelly Dowe, the city’s chief business officer, adding the dollars recovered will be set aside for more demolition work. “The real benefit to the city is to get them back on the tax rolls and get them redeveloped.”

I grabbed a screenshot of the Google map from the story and embedded it above. Not surprisingly, nearly all of the properties in question are east of the I-45/US59 dividing line inside the Loop. Tearing them down will be a boon for their neighborhoods, since properties like that tend to attract crime and stand in the way of other development. Given the proximity of many of these properties to downtown, and the high demand for such real estate, I’d like to see the city require that at least some of these places get developed as moderately priced housing. It’s the cost of the land itself that tends to dictate what gets built and how much it costs, so since these are going to sport low prices for whoever buys them, then what gets built on them should ideally reflect that. I don’t know what the best way to do that is, but it would be nice if what ultimately gets built doesn’t price the existing residents out of their homes.