Don’t freak out just yet, but do be a little worried.

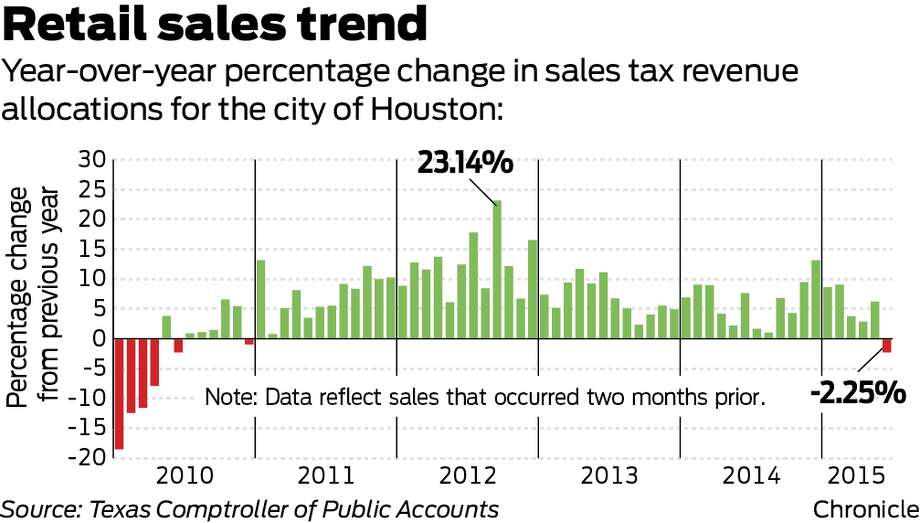

Houston’s 53-month consecutive span of year-over-year sales tax revenue gains has come to an end, five months into an energy slump analysts said could dent the city’s economic numbers for the rest of the year.

The city’s $50.1 million sales tax revenues for April, received this month as its allocation from the state, represented a 2.3 percent decline from a year ago, according to the Texas Comptroller’s Office.

One month’s spending activity doesn’t represent a trend, and revenues from various sectors of Houston’s economy were all over the map. Among the top-grossing sub-sectors providing tax revenue in Houston, reported collections were down roughly 2 percent at discount department stores and family clothing stores that month compared with 2014, and off 2.6 percent at supermarkets and grocery stores. Full- and limited-service restaurant collections, on the other hand, rose 4.7 percent and 10.1 percent, respectively, figures show.

But as Houston’s sales tax revenues declined 2.3 percent, the state’s $2.6 billion in sales tax revenue represented a 5.2 percent increased over April 2014, suggesting that a sharp downturn in the oil and gas industry so crucial to Texas has affected Houston more significantly than the rest of the state.

[…]

In Houston, sales taxes account for 30 percent of the city budget’s general fund revenue. As the city prepares its next budget, whether the monthly dip is a blip or a more sustained rattle is being monitored, city Controller Ronald Green said.

“I think now’s the time not to panic but for us to kind of determine if there’s going to be a trend in this,” Green said, adding he needs two more months of data to determine whether’s April’s revenues were a trend or an anomaly.

Compared to the doom-and-gloom predictions of late last year, steadying crude prices for the last several weeks are a sign industry is making adjustments, said Ed Wulfe, chairman and CEO of Wulfe and Co., a commercial retail real estate brokerage firm. “I think it has corrected itself already,” he said of the energy downturn. “By and large, we’re starting to get back on the normal speed and level already.”

Crude oil prices began dipping last summer after reaching a peak above $100 per barrel and have hovered around $60 since April.

The effects of that sharp price decline began arriving at the beginning of April, said Jesse Thompson, business economist with the Houston branch of the Federal Reserve Bank of Dallas.

“At this point, the only thing that’s hitting us is what’s happening in the energy market,” Thompson said.

I basically agree with Ronald Green. A one month dip like this can be brushed off as an aberration. Three months of it is a serious problem. If it’s about what’s happening in the energy industry, there’s not much to be done about it except adjust behavior and expectations accordingly. Check back in August and we’ll see where we are.