Having some Jedi mind tricks available to deal with this probably wouldn’t hurt.

About one out of every 11 dollars in this year’s city budget goes to cover pension costs.

The $165 million the city plans to send to its three public employee pensions this fiscal year is the consummation of a decades-old contract with the people who put out fires, keep streets safe and pick up the garbage.

It also is more than the city spends on libraries, parks and garbage collection combined. Within three years, the city’s annual general fund pension tab is projected to reach $265 million, or nearly one in seven general fund dollars.

The pension time bomb has been ticking for more than a decade, when, with then-Mayor Lee Brown’s support, the pension systems boosted benefits based on projections that it would not raise the city’s costs significantly. Those projections quickly turned out to be calamitously misinformed.

At her inauguration last month, Mayor Annise Parker declared progress on pensions a priority of her second term. She is due to receive a report Tuesday that will serve as the starting point on how to achieve that progress. The Long-Range Financial Management Task Force created by City Council last year is scheduled to submit to Parker a menu of options on what to do about escalating pension obligations.

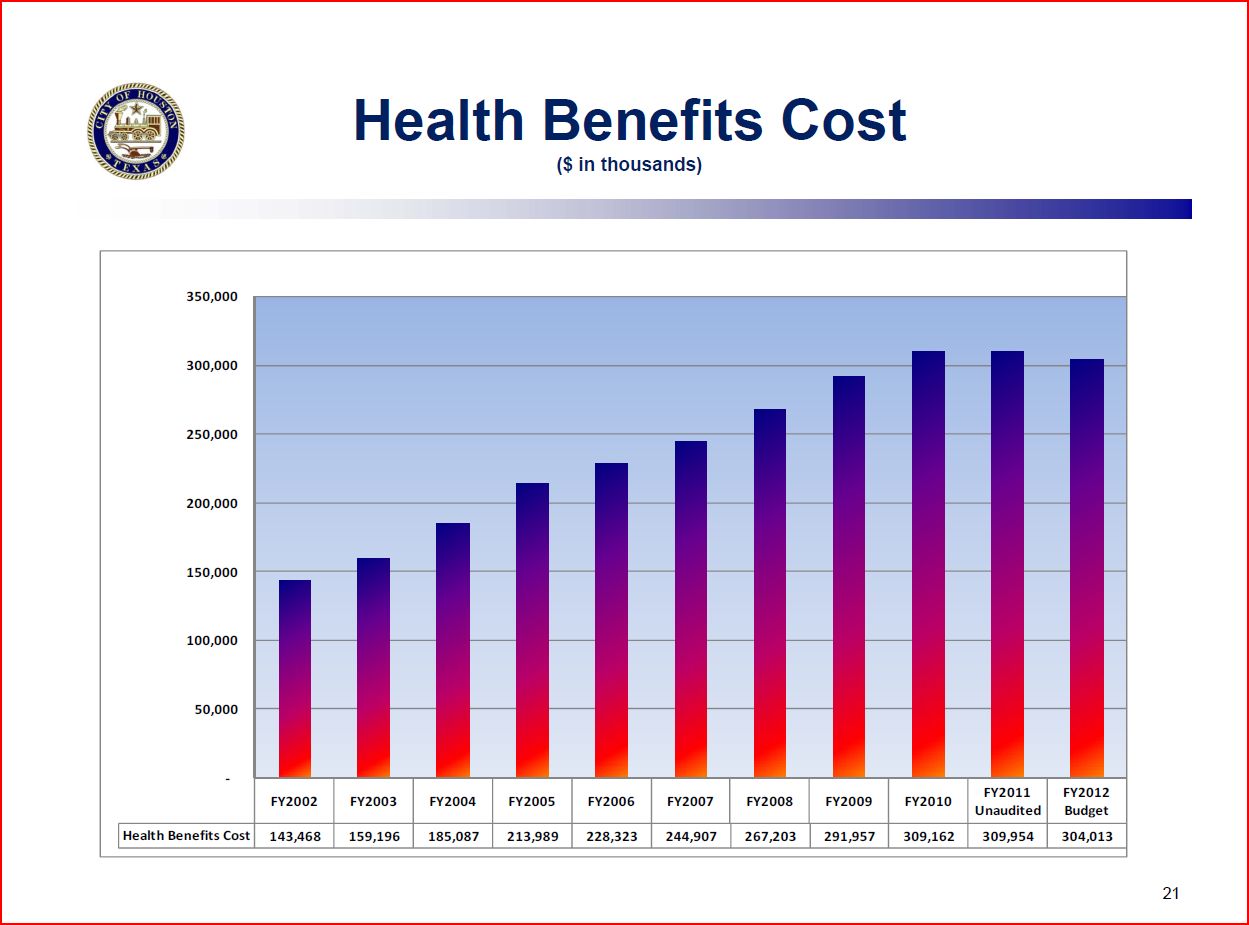

Most of what’s in this story is pretty familiar to us by now. If you have a couple of hours to kill and don’t mind memorizing a bunch of acronyms, head over to the Long-Range Financial Management Task Force webpage and browse through the Financial Planning Presentations available there. I want to highlight a chart from page 21 of Part 1 the City Financial Overview that I think deserves more attention:

Health benefit costs have more than doubled in less than a decade. The slight downturn in the last year is undoubtedly due in part to the layoff of over 750 city employees, so I’d expect it to start climbing back up again. There’s been so much talk about pensions – as the story notes, most of the Task Force’s ideas center around pensions – but not nearly as much about this. There are things that can be done about pensions, some of which require legislative assistance and some of which would be highly contentious, yet there seem to be far fewer ideas about how best to deal with this cost driver. Maybe that’s because there’s not much that can be done beyond cutting benefits or increasing the amount employees contribute to their health insurance, but I’d feel more confident about that if I saw more discussion of it. Anyone got any bright ideas?

Pingback: Brown’s part time staff – Off the Kuff

Kuff,

The main reason that the health benefits costs went down is that we changed the benefit structure to reduce costs, changed our long-time insurer for another after a spirited bidding war, and have self-insured.

I am systematically going through the top contracts (by cost and tenure) in each department for opportunitues to restructure and rebid.

Annise

With all due respect, the phrase “changed the benefit structure”is poli-speak for “we increased costs to employees and reduced their choices/benefits”. As stated elsewhere, the pension costs total less than 10% of the budget, even less if you include all aspects of the budget beyond the general fund. Those are given in lieu of 20% pay increases to bring public sector employees closer to private sector pay.

The ever increasing health costs and amount of debt (or liabilities) the city is faced with can be addressed by an austerity budget for a few years, prioritizing all expenses as needed. Employees have provided the city with many millions in recommended savings yet the same attitude Council member Brown faced on the bike trail issue is thrown in their faces. I don’t envy Ms. Parker or her successor to make those hard choices now or watch the city crash but the continued blame directed at employees is misdirected.

Pingback: Electing educators – Off the Kuff

Pingback: Houston’s health care cost problem – Off the Kuff