This is a problem for which there’s no easy solution.

Hoping to contain rising health care costs, Mayor Annise Parker recently hiked premiums and cut benefits for employees, a move union leaders said overburdens workers and some City Council members said does not adequately cut costs.

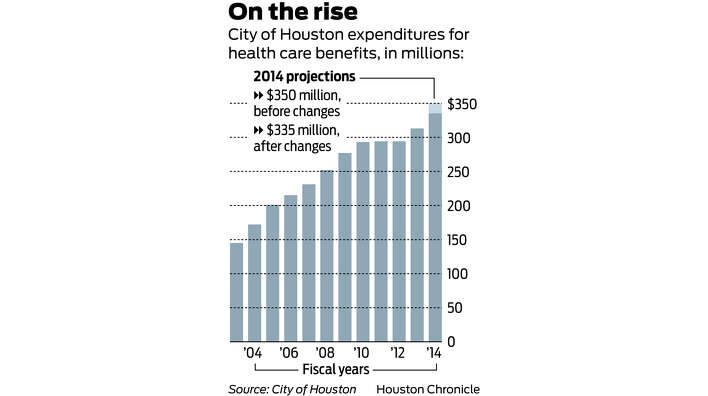

Health benefits, long a budget-buster for governments, jumped from $294 million last year to a projected $313 million in the current fiscal year, which ends June 30. Those costs had been estimated at $350 million for the next fiscal year prior to the changes; now, next year’s costs are projected at about $335 million, said Ramiro Cano, deputy director of the city’s Human Resources Department.

Roughly 10 percent of Houston’s current general operating budget is devoted to health care costs.

The city also pulled $12 million from the general fund last month to cover a deficit in its health fund, after predictions about outgoing claims and incoming premiums proved inaccurate. Those predictions followed the move two years ago from a fully insured plan – under which the city paid fixed monthly premiums – to a self-insured plan in which it pays only when employees need care.

[…]

The changes announced to employees last week will see workers’ premiums go up 14.9 percent, with the city’s share rising by the same amount. A 15 percent increase would have forced labor contracts to be renegotiated. The city will continue to pay three-fourths of the cost of health expenses, with employees paying one-fourth.

Higher premiums were not enough to cover rising costs, so the city’s health plans also were tweaked to save an estimated $10 million, much of that from higher co-pays for brand-name drugs and primary care, specialist and hospital visits.

Melvin Hughes, president of the Houston Organization of Public Employees, said some employees have told the union they will drop the insurance because they cannot afford it, and instead will seek care in the county’s public hospital system.

“City employees are outraged about it. My phone’s been ringing off the hook,” Hughes said. “My lowest-paid workers, it’s going to be real hard for them to deal with those kinds of deductibles, and just the rate hike itself.”

I want to point out that we’ve seen this chart before, and that there still isn’t much that can be done beyond increasing the cost for employees and retirees, and decreasing their benefits. Yes, you can shop around for a better plan, and there are a few more things that can be done on the margins, but as this story shows that’s where the bang for the buck is, at least until that hoped-for day when the cost curve on delivering health care really does start to bend. Whether you think the city has done too much, not enough, or somewhere in between largely depends on one’s perspective, especially if one is on the receiving end of the cost increase. And whatever one thinks of the pension issue, this is as big a part of the city’s budget, and it gets way less attention. I wish I had an answer to suggest, but I don’t.

The city’s insurance for their employees is one of the worst I’ve seen for any legitimate job. Office visits have a $40 co-pay for your GP, $100 to see any “specialist”. And that’s WITHIN the network. Beyond that, according to Cigna’s printed literature, co-pays don’t count towards the maximum “out of pocket expenses”. That’s like a catch 22 to keep you from ever being fully covered in the event of a major illness. It’s shameful, and shortchanges our city’s employees from the typical health insurance benefit.